Clear Financial Intelligence for Confident Credit Decisions

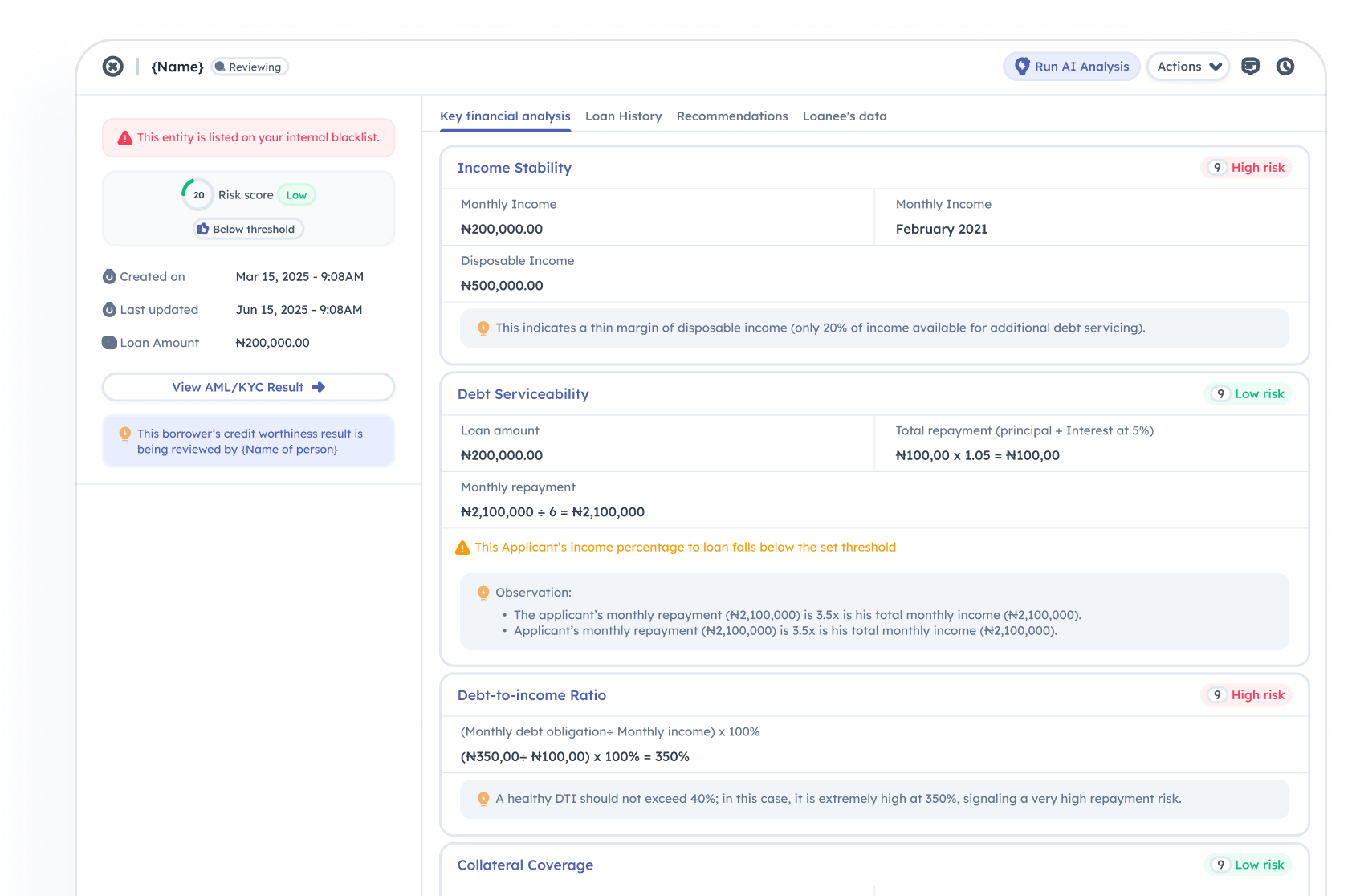

Get Financial key analysis

We conduct thorough assessments of financial risk by meticulously examining crucial indicators such as debt serviceability, income stability, and other key financial metrics. This comprehensive approach enables us to make informed, strategic credit decisions that not only drive business growth but also ensure prudent risk management, ultimately fostering sustainable financial health and minimizing potential losses.

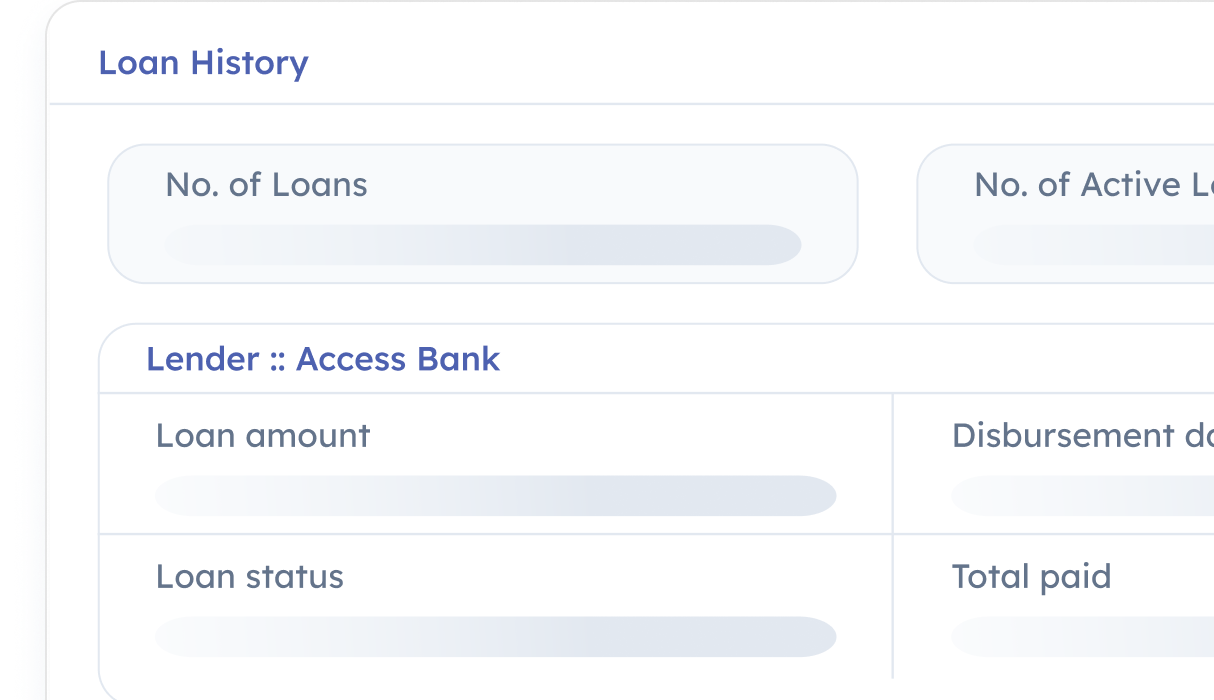

View Loan History

Access applicants’ complete loan history, including total loans, active accounts, and lending institutions, to evaluate their financial commitments and repayment behavior.

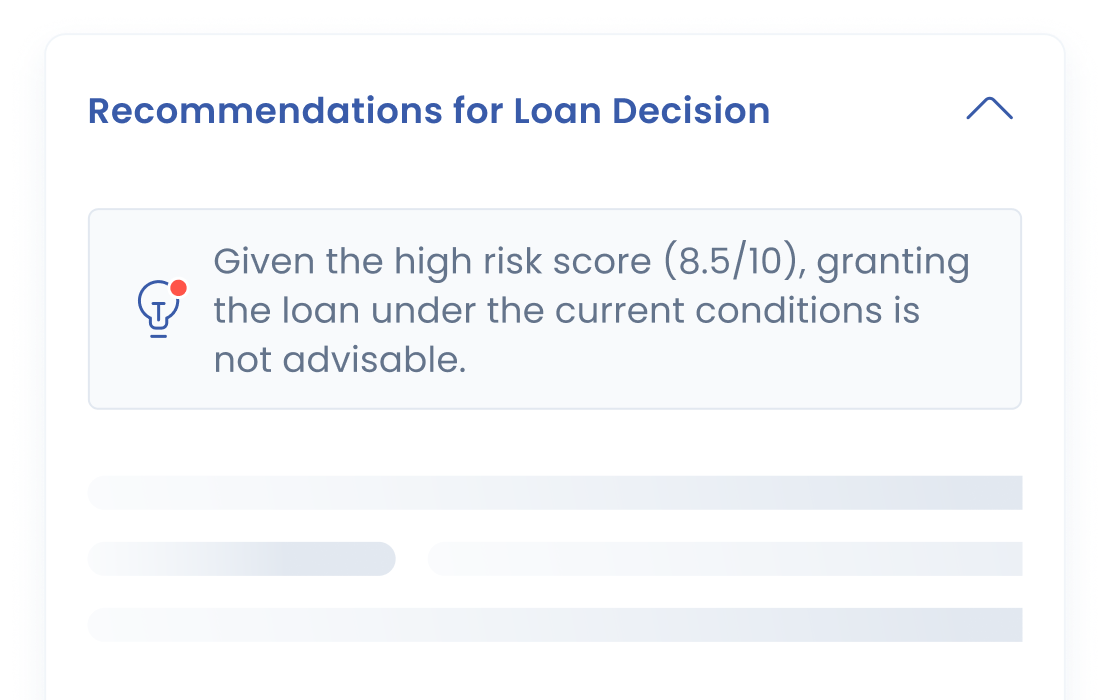

Get insights & Recommendations

Analyze key financial indicators such as credit score, debt levels, and payment history to generate data-driven recommendations for confident lending decisions.

Move from uncertainty to clarity in every loan decision.

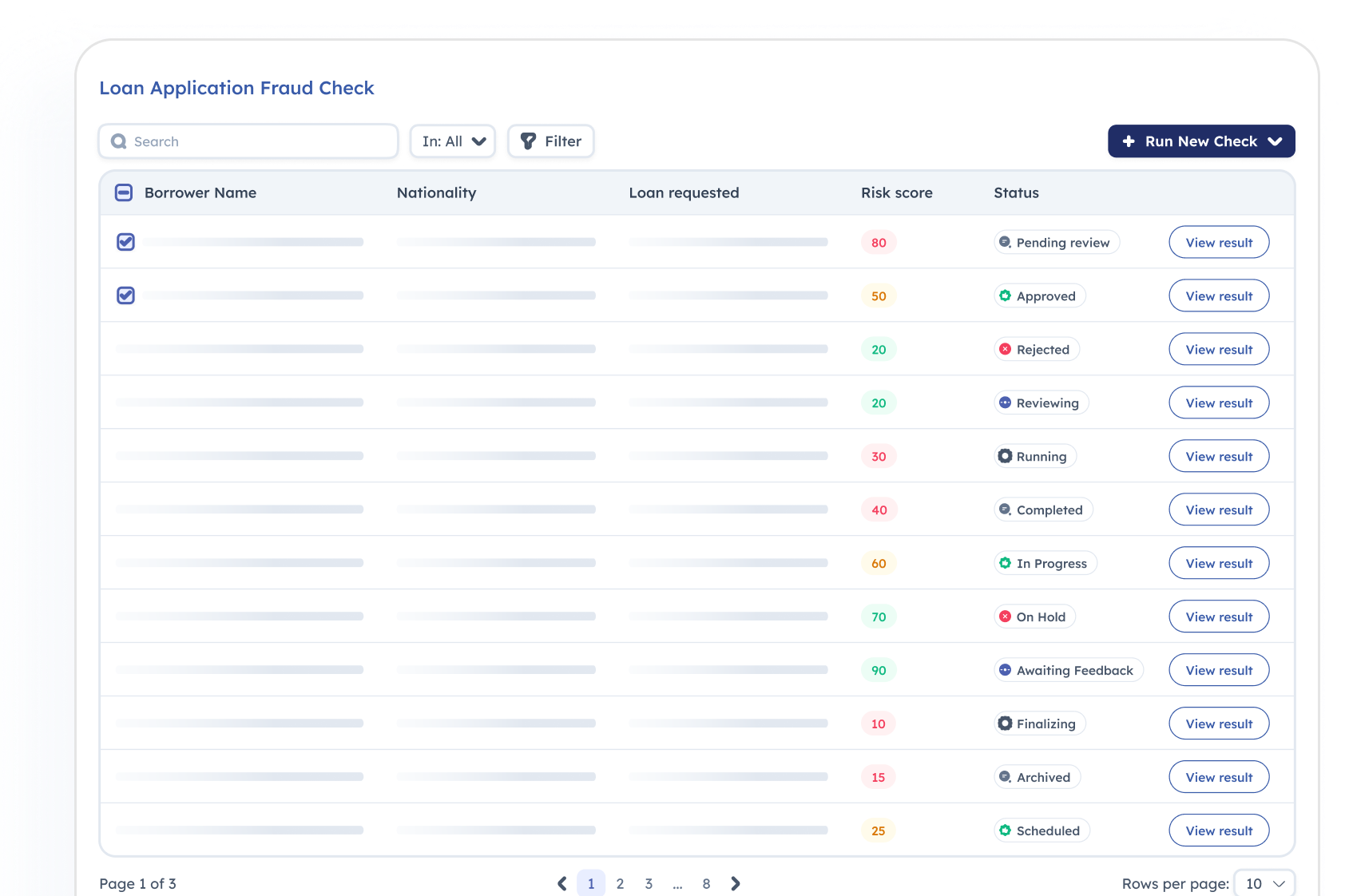

Fraud Score Calculation

Access up-to-date credit scores that reflect the current financial status of borrowers, allowing for timely decision-making.

Automated Report

Generate detailed credit reports automatically, providing clear insights into the creditworthiness of individuals or organisations

Alerts and Notifications

Generate detailed credit reports automatically, providing clear insights into the creditworthiness of individuals or organisations

Historical Data Tracking

Monitor changes in creditworthiness over time, allowing for more informed lending decisions and risk management strategies

Integration with Existing Systems

Seamlessly integrate the creditworthiness feature with your existing CRM or financial systems for a holistic view of your clients.

User-Friendly Dashboard

Navigate an intuitive interface that presents credit data and scores in an easily digestible format for quick analysis.

Fraud Score Calculation

Access up-to-date credit scores that reflect the current financial status of borrowers, allowing for timely decision-making.

Automated Report

Generate detailed credit reports automatically, providing clear insights into the creditworthiness of individuals or organisations

Alerts and Notifications

Generate detailed credit reports automatically, providing clear insights into the creditworthiness of individuals or organisations

Historical Data Tracking

Monitor changes in creditworthiness over time, allowing for more informed lending decisions and risk management strategies

Integration with Existing Systems

Seamlessly integrate the creditworthiness feature with your existing CRM or financial systems for a holistic view of your clients.

User-Friendly Dashboard

Navigate an intuitive interface that presents credit data and scores in an easily digestible format for quick analysis.